Here’s why you can’t be sure most insurance agents are doing

what’s best for you:

Firefly agents make insurance easy and affordable for you. The message on their websites is usually:

One agent – Lots of Quotes – No hassle – Guaranteed.

And they make good on this promise. But there’s more.

In fact, there’s one big thing you need to understand:

The way insurance distribution works, you can’t be sure your agent is doing what’s best for you.

It’s not because your agent is bad. It’s because the system that they are in prevents them from putting you first.

Here’s why, in a nutshell.

Single company

Many agents represent only one company, like Allstate, State Farm, or Farmers. Some companies sell direct, such as GEICO. The agents are likely doing their best, but with only one company to represent – how can you be sure that you are with the company that’s best for you?

You also have to call, contact, or visit company after company to compare rates. It’s like needing to go to separate stores to compare shoes by Nike, Reebok, Adidas, or other brands.

Small independent agent

An independent agent can sell — on average — for four insurance companies. This helps them begin to overcome the coverage and pricing obstacles of the single-company agent.

But there’s another problem.

Each insurance company requires that agent to bring in a significant amount of premium each year.

If the agent fails to meet the insurance company’s quotas, the company won’t let that agent represent them anymore. If that happens, not only can they not quote that company anymore, but any existing commission from that company will also be taken away from the agent.

Naturally, the agent must focus on meeting the quotas of each insurance company. That means when he or she has to decide between offering the best price for you, or meeting a company quota, the quotas sometimes win.

You have to wonder: What if you’re one of the customers they put with the more expensive companies? You’d never know it.

Like the agent who only has one company, how can you be sure that you are with the company that’s best for you?

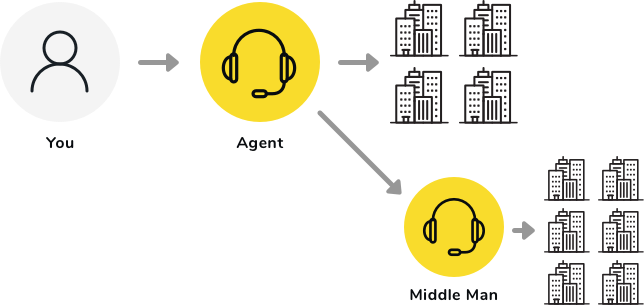

Independent agent, working with an aggregator

Like the small independent agent above, this agent has 3-5 main companies, along with sales quotas from those companies.

This agent also partners with an Aggregator to get “access” to many additional companies. So the good news is that they can quote more companies for you. Maybe even a dozen. But there are two big problems, from your perspective.

The first problem is quoting and servicing your policies. Usually, the agent can get you quotes right away for their main 3-5 carriers. But to work with their other companies they have to give your information to their Aggregator — essentially a middleman — to finalize your quotes, or to issue or service your policy.

The delay of a middleman is inconvenient and slows things down for the agent and for you. But the real problem for you here is the agent’s compensation — combined with those sales quotas.

The middleman doesn’t work for free. So the agent usually gets paid about a 40% lower commission on any policies written through that Aggregator.

When an agent gets paid 40% MORE for selling their main 3-5 companies AND has sales quotas to be able to keep selling those companies, they have a huge financial incentive to put you with those companies . . . even if one of the middle-man’s options is better for you.

If this is your agent, how can you be sure that you are with the company that’s best for you?

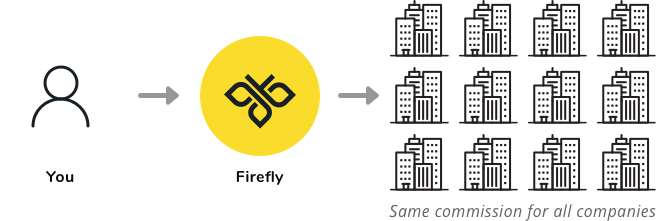

Firefly agents are different

We are not an aggregator. Firefly agents are part of one very large insurance agency, which solves both of the problems above.

1) They have no pressure from sales quotas.

Our agents are not judged on their own sales quotas. They can put 5 or 500 customers with one insurance company, and they don’t have to worry about losing the ability to sell that company. They can also quote and service all of their insurance companies directly, with no middleman.

2) They get the same high commission with any insurance company they put you with.

Firefly agents don’t have primary and secondary tiers of insurance companies. You don’t have to worry that they have an incentive to put you with a favorite, higher paying company, when another option would be much better.

- In short, a Firefly agent is free to quote you with all of their carriers and match you with the one that’s best for you – every time.

- Better still, our typical agent can quote you with more than 12 insurance companies! That makes us more like the Amazon of insurance. Go to your Firefly agent to get the widest, deepest set of quotes and options around.

- If you’re already a Firefly customer, enjoy the savings and peace of mind that you get from our agents.

- If you’re not with a Firefly agent, ask yourself: Which one of these agents do I believe can do what’s really best for me?

Need to Reach Your Agent?

Not everybody remembers the name of their local insurance agent! We’re not vain enough to think that you would. If you need to contact your agent, but cannot track down his or her information, call our General number at (614) 761-2825 and we will point you in the right direction!

A customer working with a Firefly agent:

“I have been insured by Firefly for many years . . . They are very competent and helpful for all my insurance needs for auto, home, and business. They do a great job at customer service. They are trustworthy. Just the other day, my agent did a review of my coverage, without me even asking, and found that by switching from one company to another for my umbrella policy, he saved me 50% on premiums with the same coverage!”

— Matt W.